Payment Agreements

Establishing effective payment agreements lies at the heart of the debt collection process. Whether it’s arranging a swift $100 payment within a week or structuring a six month arrangement to settle a $50,000 debt, debt collection can be the best solution for you. If you find yourself grappling with a debtor who is struggling to meet their financial obligations on a consistent and timely basis, turning to debt collection might be the optimal solution for several compelling reasons.

Negotiation

First and foremost, the debt collection process brings a structured and organized approach to the often challenging task of recovering outstanding payments. Debt collectors are adept at evaluating the financial circumstances of debtors, understanding their capacity to pay, and tailoring payment plans that align with both the debtor’s financial capabilities and the creditor’s need for resolution. This meticulous assessment ensures that the proposed agreements are realistic and achievable, increasing the likelihood of a successful agreement.

Time Savers

In addition to handling negotiations in an ethical manner, debt collection emerges as a reliable strategy to minimize the time spent on completing a job. Debt collectors not only possess the resources such as direct debit software, ensuring timely payments, but they also shoulder the responsibility of managing follow-ups and reminders that would typically demand the attention of creditors. By entrusting these tasks to debt collection professionals, creditors can significantly reduce the time and effort involved in overseeing the entire payment process. This delegation allows creditors to focus on their core responsibilities, while the debt collection agency efficiently manages the intricacies of ensuring prompt and consistent payments, resulting in a more streamlined and time-effective resolution.

Avoid Needless Legal Action

As debt collectors are seasoned with experience, they can see many different paths to recover your money including court. Court can be the wrong answer when dealing with debtors in financial hardship. After a potentially costly and timely process, the courts may only order the debtor to pay in a payment agreement meaningful to their situation. Debt collection can bypass this process to get the same result for so much less.

Security

Debt collectors also bring a level of expertise to the table that is crucial for navigating the legal and regulatory landscape surrounding debt recovery. With a deep understanding of the relevant laws and regulations, debt collectors can ensure that the payment agreements are not only effective but also tick compliance laws and protect you if an agreement goes south.

If you are having issues with a debtor not making regular instalments, please contact us to see how we can best save you time in your situation.

Avoid Using Debt Collection

Many businesses avoid using debt collection as they have no use for it. By our existence as a company, you can tell many others cannot avoid needing recovery services. How do they do it?

It may seem counter-intuitive for us to advise how to avoid using our services. However, your efforts to mitigate unpaid accounts relieves time and stress on your end and makes collection efforts more straight forward if needed.

Here are simple things you can do to your current system to mitigate debts in the future.

Prepare

To avoid using debt collection, you need to prepare for the journey your invoice may take. Just like a family outing where you need to bring hats, water bottles, food, a book for kid 1, spare change of clothes for kid 2 as they always get messy, GPS tracker for kid 3 as they always run off…..

There are so many things which could happen to your invoice. As the example above also shows, the more work you have, the more that can happen and the more prepared you may need to be.

This can look like changing your workflow from calls to confirmation in writing. Maybe your next step is written and signed contracts. What about having a scheduled process to follow invoices along their perilous journey…

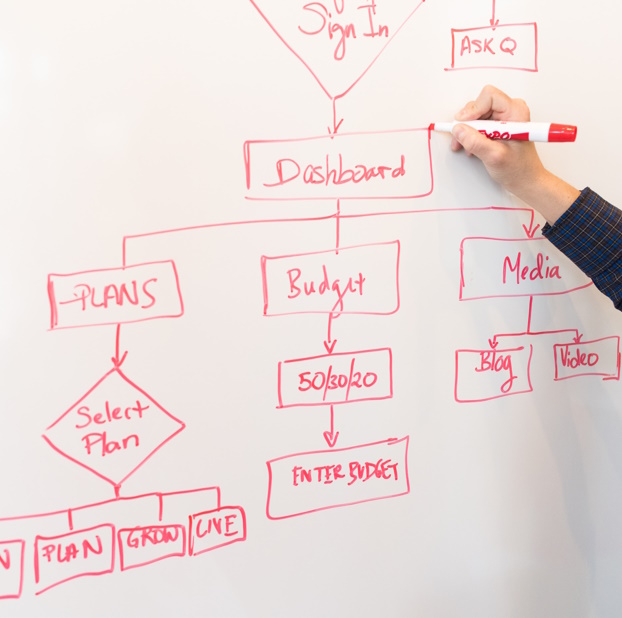

Process

I am a simple guy, my brain works 1-2-3, cause and effect, what is the next step. We believe to avoid debt collection, your accounts should be similar. For example:

- Due Reminder

- Follow-up #1 X days overdue

- Follow-up #2 X days overdue

- Final Warnings X days overdue

- Action

Having a set template for follow-ups keeps the stress of figuring out how to get your payment away. Doing this keeps the pressure on your debtor and creates the urgency for payment to be made. We find creating an ethical sense of urgency and importance to a debt is one of the best ways to recover debts.

A process cannot be the be-all and end-all as a debt is not always cut-and-dried. Sometimes some finesse is needed.

Propose

So there’s more to your debt than meets the eye. Does your debtor dispute the invoice? In financial hardship? Ceasing communication? Making unfair demands? This may hurt, but sometimes you must swallow up your pride to resolve the situation, whether the principle is correct.

Although it may be difficult, proposing alternative ways to resolve the matter can be the final steps you can take to avoid using debt collection. This step really depends on how willing you are to settle for a lower amount or agreement.

As every situation is different, we can recommend is that all proposals is put in writing. If it’s a settlement, put forward a without prejudice offer to save on costs with 7 days to accept – that kind of thing.

Then what?

Worst case scenario, you are left with us, the collectors.

Thankfully, we are used to the situation never being the same and we are ready to deal with what you have to throw at us. If you are unsure if you have done all you can to chase up an unpaid invoice, give us a call. We will be happy to discuss if you have done everything you can to avoid using debt collection and what we can do to assist.

Better Accounts Equals Better Profit

A good business owner is always counting the cost of the work they do. For a builder, this is moving their margin when material costs rise (thanks COVID), for a mechanic, it is quoting for the time the job will likely take, for the accountant it is billing for the time spent working on the books. Despite this, time spent chasing up unpaid invoices isn’t always taken into account and it can really eat into your profit by taking you away from what you do best. Whilst it is a necessary evil, we will let you in on a little secret, better accounts equals better profit. Here is why:

Time Wasted

It is easy to get caught up in perfecting your trade and leaving accounts to themselves. Unfortunately, we live in a world where reminders and follow-ups are needed to get things done. Keeping on top of your invoices and payments, increasing your cash flow will also give you peace of mind, help you sleep at night. That being said, every call, text, email, letter and meeting is a time where you could be either working, earning greater profits, living life or anything else that is not wasting your time and effort.

Despite all the time and money saving you are achieving in your work, the time wasted here can make a large debt in your earnings.

Lack of Accountability

Forgetful clients are one thing, what about the evaders or fighters? Unfortunately they exist, many for very good reasons. Ensuring that they are aware that you are watching all your outstanding debt and incoming payments, makes them more likely to pay. The squeaky wheel gets the grease, so to speak. Even so, following these clients up can be one of the more time consuming processes. Long term outstanding accounts can be the difference between a successful and stressful year.

An example we hear all to often is a small $2k invoice which has had hours upon hours of discussions, meetings and attempts to contact without payment. Unfortunately in some of these cases, the client had no reason to pay immediately as there was no real pressure to do so. Having the correct forms, contracts and plans for these clients is imperative to ensure you are paid.

Some ways to combat this are having the paper work and repercussions set up, like what we assist with in our free protection audit (shameless plug). Being able to legally on-charge admin fees, collection fees, interest and potential legal fees will allow you to be able to hand the matter to debt collectors without having to worry about more time and money wasted.

Lack of Process

So you are a smaller business. Family run? Sole Trader? You may not have or have needed a real process to your accounts management. What steps do you take to ensure you are paid? How can you get better accounts and also get better profit? Some important steps are:

- Credit check prior to engagement

- Quoted works in writing

- Consistent follow-ups for a set period of time

- Firm dates and firm repercussions as a result of prior written agreements

Lack of Time

Especially if you are a smaller business or maybe a larger one with too many invoices to chase up, there is not enough time in the day to recover everything. Most businesses will hire a bookkeeper for a few days a week to cover this. Well done, what a great first step! If you are unsure of what you could do next, our next shameless plug is our Accounts Receivable Process.

Let us handle your accounts for you. Guaranteed, consistent follow-ups, advice and ease of moving those harder cases straight to collection. Have a look at our page here for more info on what this looks like for you and if we can fill the gap in your business. We hope that we can give you a better accounts process so you can have a better profit. Let us take on the stress of collecting your payments so you can continue doing what you do best. Making money.

Common Reasons Why Court Won’t Work For You

Some of the most common reasons why court won’t work for you are simple, others are more complex. We want to make sure that if legal action is necessary to recover a debt that you are making a well-informed decision. To help you along, here are some of the reasons we advise against court with out clients.

Not the End of the Road

Let’s take an example from the Victorian Civil and Administrative Tribunal (VCAT). We have a client whose debtor has stated that we can take him to court and he is still not going to pay the $300 owed. VCAT and other tribunals will provide a judgement, but does not end with a physical enforcement of the result. If we take him through VCAT, we will then need to take the matter further to an enforcement hearing.

An enforcement hearing at magistrates court can be costly in terms of payment and time set aside. With solicitor involvement, the matter starts to blow up to the next level. Is it worth it for the $300?

Lack of Information

Some recoveries we do start with a first name, 10k owed and a disconnected phone number. We welcome a challenge but the courts may not look too kindly towards it. Court requires the respondent served the documents so they actually know that there is a case against them. We do skip tracing to find more details on the subject, but sometimes they can be incredibly hard to find. Melbourne Investigations explain the process of skip tracing well in their blog here.

Without a means to take person to court, it can be a fruitless process.

Costly

We hear some horror stories of clients spending 25k to recover 20k. Our court cases are paid upfront prior to moving forward to avoid this. When a case moves forward to the next step like the aforementioned enforcement hearing, things could get out of control. If we can see this being the case, we may advise against court.

Court costs can be recovered to an extent, but sometimes it is hard to count the cost.

Time

Preparing for court can be time consuming, even if you have someone like a collector or solicitor preparing the way for you. For some businesses, it’s not worth chasing $6,000 in court as they would lose this in time spent preparing for court. On the other end, some courts can be slow with 10 month wait times to get the case on the table. Maybe this is too long for you to wait for a solution.

Other Options

Debt collectors like ourselves are always looking for the best way to resolve a case. We try to avoid some of the issues court produces. We avoid costs, time extensions, hassle on your end and any nerves the word ‘court’ might produce. This could be by trying another avenue first like:

- In-House Escalation

- QBCC / DBDRV / Fair Trading

- Credit File Implications

- Statutory Demands

Whatever the situation, we hope we can give you the options forward to recover your debt. This can sometimes mean court is the only option, even if it’s not a good one. Are you confused on what avenues you have? Feel free to contact us on info@henleyrecoveriesgroup.com.au with your situation and our collection agents will be happy to advise on what we can do in your situation. Otherwise, you can submit a debt with us and we will let you know what options should present themselves as we move through collecting your case.

The Sooner You Are Paid, The Sooner You Move On

We believe the sooner you are paid, the sooner you move on. Just like it can be hard to attend to an old broken relationship, it can be hard to attend to debts which have left a bad taste in your mouth. We understand that some things need to be dealt with head on to move on while others need more sensitivity for all parties involved.

For some businesses, seeing that debt sitting in the accounts system may bring up similar feeling of dread as seeing your ex-friend at the shops. We are not councillors here at Henley Recoveries Group, but we do know how to get rid of that invoice for you!

Rip Off the Band-Aid!

Remember the band-aid you left on for a week as a kid because of the fear of the pain? It’s time to rip off the band-aid, or I should say, attend to that debt!

Some debts can be time consuming or stressful to deal with. This can be why it’s been left sitting for a few months or maybe a few years.

If this is you, we can assist when you submit a debt with us. We love it when we receive your submission, deal with the situation and come back with full payment without need of your intervention. We do this in cases to make sure no more of your time is wasted is following up the matter. To do this, we need as much info on the matter as possible. This can include:

- Quotes

- Invoices

- Contracts

- Purchase Orders

- Additional Requests

- Text history

- Email Trails

- Description of the situation

Any and all of this can assist us in collecting a debt without you having to re-visit the old band-aid. You can also let us know that you want little to no involvement so we can act in the best way possible. We will work with you to help you move on as easily as possible. This being said, there are sadly some debts which need the attention. When there are legitimate disputes, offers and legal processes involved, we like to work with you to find how you would like us to act in the situation with the evidence that has been involved.

Don The Boxing Gloves

Maybe you are the type who wants full control of chasing up the debt but you lack the extra authority or knowledge. We are also here to assist in this situation. We walk many clients through the proper avenues of collection using the experience of our collectors. For example, your debt may be able to be enforced by multiple avenues such as:

- Credit Default / Mercantile Enquiry / Credit File Implications

- QBCC / DBDRV / Fair Trading

- FEG / ATO / Fair Work

- Statutory Demand / Windup Proceedings

- Process Service

- Garnishee Wages / Caveats / Repo

- Small Claims Tribunals / Local Court / Magistrates etc.

Our aim is always to resolve prior to any action but it always helps to know what will work best in any situation. When we work a case, we always have in mind the future steps to how a case can pan out. We can work with you step by step with how we escalate the matter so you can choose with our own recommendations how you want to deal with the debt.

Armour Up

We cannot stress enough how important preparing for the worst is. Putting armour on your business can help you avoid all the debts which may leave you needing a figurative band-aid. Things such as signed agreements and clauses can mitigate unpaid invoices. As we always market to our clients, we give a FREE AUDIT on your current protection for your business. We give you the materials to protect yourself moving forward so you may hopefully avoid future old band-aids.

Metaphorical language and fluffy words aside, our heart in this industry is to assist your business in running in a way which avoids debts but also knows how to recover unpaid invoices when the worst occurs. We have been engaged to help and collect for many reasons including relief to emotional strain, saving the business’ time, difficult disputes, MIA clients and legal action. Over the years of operation, we have helped many businesses recover their lost earnings or advised them on what went wrong and how to avoid it. We hope we can do the same for you so you can sooner move on.

Common Excuses from Non-Payers

As debt collectors, we get many common excuses from non-payers regarding why we shouldn’t be involved. Whether it’s true or not, the fact remains that you have not been paid for your services. It’s our job to nut out the situation to find the best way to get you paid.

I Was Never Told

The first of the common excuses from non-payers is the client who plays unaware. This can range from a client who legitimately has never received an invoice or one who purposely has been evading. The next steps for these cases are simple; they have the invoice now, get it paid. This sometimes can take more effort for those debtors who reply with, “I thought I didn’t owe them because they stopped following me up.”

To avoid having these debtors, we advise that you:

- Collect as many contact points before beginning work.

- Make sure you contact your debtor on every point of contact (within reason) if no response is made.

- If you did work at their premises, you may want to drop by with good intentions. Hand the invoice to them directly to confirm they received it.

- If you can confirm that they received your invoice, be quick to act if invoices go overdue.

- Submitting a debt to a debt collector early will enhance your chances on a successful collection. Remember, if they have previously agreed to it, we may be able to add on our fees. Free debt collection!

I Told Them to be Patient

You told them to pay, they said to wait. Unfortunately, we have had a recent influx of these regarding solar panel installations and similar types of work. It is confusing to hear that a request for the install was made without any money to pay for it. Whether the client intentionally is playing the system or legitimately is having a hard time, there are ways to avoid the issue.

Pre-agreed processes like deposits, progress payments, certification on final payment and late fees can help avoid this type of situations. If financial hardship has come out from nowhere, we encourage our debtors to chip away at the matter with regular payments. Everyone should be able to pay something. A small payment may seem like a joke, but it confirms the debt being owed. It also resets the statute of limitations.

I Stubbed my Toe and Broke 2 Arms

I believe we have heard this one twice now. The problem with both of them is that they weren’t claiming they couldn’t work, they just emailed that they couldn’t access their bank account as they couldn’t move their fingers. Again, they emailed it.

To cover all the more weird reasons, the facts are still the same – money is still owed, they need to get it paid. Most debt collectors will have a multitude of ways which payments can be arranged for all situations. Sometimes being flexible can help, other times calling out a silly situation can result in payment.

I Am Angry So I Will Not Pay A Cent

Yes, but it is still legally owed – are you starting to see the trend? So many of the excuses require a calm voice to confirm they hear the issue before pushing payment. We find sometimes swallowing any pride towards the situation can result in payment, other times, escalating the matter to court. This could make your client realise the gravity of the situation. If not, you now have a legal judgement to show they have misunderstood their position.

Many times when we escalate to court in our debt recovery process, it’s for the reason that the client is misinformed on their position. All that is needed was payment to be made to fix the reason for their anger.

I Dispute The Debt So Take Me To Court.

As debt collectors, this can be a sign of a false debt or someone who has really been hurt by the system. It is in everyone’s best interest to avoid the time and money in preparing for court. We strive to get your debtors to open up about the issues so we can be more of a mediation service. If there is legitimately issues at hand, we work with you to find what is meaningfully owed to get the best outcome for the situation.

There are always ways to address any type of excuse. Sometimes it can be tricky to find the right way to address the situation. We hope that insights into the common excuses from non-payers we get and how we deal with them can help in your own business.

Looking for the Warning Signs Before a Client becomes a Debtor

30 years in the business and never had an issue

It’s always great to hear the many success stories from businesses who succeed in avoiding debts. The sad reality is that this sentence is usually followed by “… until this one fella ripped us off so badly.” Unless you are paid prior to the work being done, there is no escape from the reality that humans don’t always do what is right. We see a plethora of different debtors, malicoious and accidental. We would like to think that most of these situations are avoidable before work even begins.

Why should we bother checking?

It’s great if business works well, but what if the one job could ruin it all? Many of our clients and debtors alike have been burnt by that one larger job they accepted which ended up turning the business upside down. For the smaller jobs, so much undue stress and time is put in to a situation which should never existed! It’s sometimes more frustrating that more time is needed to chase up a $100 bill which had little margin for your business. Either way, checking for warning signs prior to work for any job can save future hassle and hardship if done correctly.

“I wasn’t sure about them from that first chat…”

Whether you are potentially judging someone hard or have your Spiderman tingle firing, trust yourself and look further before starting! More often than not, there is a reason for your suspicions. This can include:

- Unwillingness to pay a full deposit

- Negotiation on a set price from the get-go.

- Lack of personal contact details

- Lack of communication

- Requests to delay invoices

- Go-Lucky/carefree attitude towards payment schedule

- Avoiding anything in writing/word of mouth only

- Bad credit history

- Other debts

- Past work not finished by past businesses

- Job is for a client moving away

- A Silver Tongue and promises which never eventuate

Many of these signs are easy to see but it’s hard not to try and help a client in need. We hope that if you cannot act for every client that you can take the right precautions to avoid future implications.

PREPARE!

Usually, 30 years of no debts means you have a good system in place. A quick check on a program like CreditorWatch can mean a world of difference as you can see credit scores and current credit ratings on the business. In addition to this, we always advise to protect your current contracts and potentially invoices by using our free protection service. We love to look at what we can do to help you avoid debts and cover you if you do have issues with non-payers. Again – it’s all free, no payment later on, no half finished job – Free. What are you waiting for?

What if it’s unavoidable?

If you are in business, a debt will pop up one day, that’s why we are here to help. With the protection in place, our recovery services can be free to you. We believe in our process and our drive to get your money back. If you are looking to recover for financial reasons or just the principle, don’t hesitate to contact us – we are here to help.

We have more blogs for our services and notes from experience in this industry. We hope you can profit from these and avoid situations with unpaid invoices.

Henley Recoveries Group are a no-win, no-fee debt collection agency with an excellent track record of collections. Recover your unpaid invoices by submitting a debt with us.

Contact us on our main phone, 0466 243 114 or email info@henleyrecoveriesgroup.com.au to discuss how we can help.

Financial hardship, bankruptcy and insolvency

Overdue invoices which involve financial hardship, bankruptcy and insolvency are some of the hardest cases to collect. Whether it is with an individual or a company, there are still ways that you can avoid or collect your invoices.

For clarification, we are dealing with an owing party who has not declared bankruptcy, external administration or liquidation. There is some great info HERE from ARITA regarding definitions of these processes. Another link HERE for more info on voluntary administration and liquidation from the Bankruptcy Advisory Centre.

Mitigation / Protection

Debtor Companies: If you have signed agreements for your services, a director’s guarantee can go a long way in collections. This makes the director personally liable to pay off the debt, even if the company does liquidate in the end. Usually it includes terms such as debt recovery and legal costs to be on charged to the debtor/director.

Unfortunately, many debts come our way where the debtor is liquidating with no director’s guarantee. Our clients are required to wait in line for funds to be distributed to the creditors, providing there are any funds at all.

Having protection such as this is one of the best tactics in coaxing payment from your debtors but can add extra time and paperwork to the whole process. If this is you, then there are a lots of complex processes to get your head around to move forward with recovering your money.

Debtor Individuals: These cases seem to have more wiggle room with where they can go. The more info you have, the better. Signed agreements are always best, but any written confirmation of the debt itself can help with future collection. The original signed terms always come in handy whether the matter ends up being taken to court or further negotiation.

Patience

Sometimes the answer for collection is to wait for the opportune moment. If we can see the intent of a debtor is to pay, an option is to set up a payment agreement to achieve the following:

- Reset the statute of limitations – This is basically the life of the debt. Most states in Australia mark a debt age to be 6 years from last payment or written admission of the debt or 12 years from last legal judgement of the debt. For a debtor who cannot pay off the debt in full, we want to make sure they do not “outlive” the debt.

- Proof of intent – Although we can argue that this is for further proof if legal action is necessary, this is actually more for the debtor themselves. Generally, debtors feel that they are taking responsibility for a debt when beginning payments. The debt begins to become less of a scary problem and more of a fixable situation. A willing payer is the best situation you can have as every cent available will be paid to you.

- Chip away at the debt – As well as the debtor feeling responsible, if action is needed down the track, legal costs potentially are lessened if the debt is smaller.

- Potential change of situation – All these things combined lead to the moment we are waiting for, full payment of the overdue amount. Your patience can be rewarded with the company or individual’s life making a turn to a brighter future. The result is a debt still chaseable in the statute of limitations, a debtor who feels responsible and they have already contributed to the debt who now wants to resolve the matter.

Money

The other way to do things is to push for legal action. Some debtors need a nudge to get resolution and this situation is no exception. There are costs to go down this path. Thankfully, proper protection potentially pushes those fees to your debtor. I will clarify that we generally advise further action when no meaningful agreement can be found.

As there are many different scenarios, it is tricky to define a solid process to resolve these cases without information but our goal is always the same.

Coax payment with the least amount of action possible.

We hope to do this as to:

- Save on further costs

- Save time on potential lengthy wait periods with the court system

- Keep the situation open for meaningful agreements with the debtor

How do we help?

The majority of best results come from speaking with your debtor openly about the situation. This includes talks about the future actions we will need to take if we cannot resolve the situation. We have the tools and experience to find what method or future procedure will give the best chance of recovery.

For example, your debtor may receive serious fines and criminal charges if their company is found trading insolvent. They may have been resilient to a point, but further discussion may lead to a meaningful agreement to benefit the parties involved.

Whatever the situation, we will advise so you may make the right choice for the situation. We hope that if you submit a debt with us, we can help you find the best resolution to your situation.

We have more blogs for our services and notes from experience in this industry. I hope you can profit from these notes written.

Henley Recoveries Group are a no-win, no-fee debt collection agency. Recover your unpaid invoices by submitting a debt with us.

Contact us on our main phone, 0466 243 114 or email info@henleyrecoveriesgroup.com.au to discuss how we can help.

The best time to recover a debt.

After the last blog talking about old debts, we had questions regarding when is the best time to recover a debt? A case can be made that some debts require a time to cool down and breathe before attempting to recover once more. Others may claim for slow payers that letting your client get in a better financial position can be profitable.

None of this is false, every debt is different and involves different people in unique situations.

So when is best?

As soon as possible – let me explain.

I agree that so many circumstances can affect timing, including the above and your own budget, unless you are protected. We see this every day in every case. Every situation has a key moment where all the cards are lined up and the chances are the best they can be. Sometimes collection happens after a 2 minute talk with a debtor, sometimes after 3 emails and others after almost winding up a company.

My question is, why risk it? If someone owes you money, chances are you aren’t the only one. A few articles including 10 Biggest Mistakes People Make When Paying Off Debt (written by Bill Fay) mention many debtors fall into the trap of a snowball effect of debts. Most helpful organisations push debtors to pay off one debt at a time. What happens if you follow-up on payments for a year before collection? You are now at the back of the line.

Recovering Debts is what we do.

No matter what, the best time to recover a debt is a soon as possible. If instant resolution isn’t the answer, we can provide the tools and structure to ensure when the opportunity is there, the collection can happen. To avoid the mistake of chasing up a payment for a year and wasting your valuable time, let us do it for you. Our team is trained to find the best solution at ANY age of debt and we hope we can show you this with results.

Although this is just a short blog regarding age of debts, it’s really a short answer to an even better question. When do you want your money paid?

On time – Use accounts receivables to help.

Now – Use debt collection

Someday in the future – We will be here for you and happy to help.

We have more blogs for our services and notes from experience in this industry. I hope you can profit from these notes written.

Henley Recoveries Group are a no-win, no-fee debt collection agency with an excellent track record of collections. Recover your unpaid invoices by submitting a debt with us.

Contact us on our main phone, 0466 243 114 or email info@henleyrecoveriesgroup.com.au to discuss how we can help.

Recover your write-offs.

The Issue

Sometimes it just doesn’t seem worthwhile to recover your write-offs. The job is done, the invoice has gone out, 5 calls and 10 reminder emails have been sent. Any more effort would be a waste. It could be that the debt is small or just in the “too hard basket”, but it is sad to never see the hard earned money.

Our hope is that we can help out in this situation whether it is with our Accounts Receivable process or Debt Recovery further down the line.

Is this worthwhile for me?

We pride ourselves with being able to work through a collection case as autonomously or as particularly as requested. When this is applied to one of these write-offs, we move to a more autonomous process. We look to produce results with the least amount of effort on your part. This includes debts from up to 6 years ago, silent debtors and those who promise over and over to pay…

Many of our debts we collect are quite small, under $500. Our Accounts Receivables clients have a different experience with these than our normal debt collection process. Our system picks up on these debts before they become debts, before debt recovery is needed. Sometimes a good accounts system is all you need to avoid the pain a stress of a debt unpaid.

What’s the catch

With some of these write-offs, chances of collection can sometimes be lower than our usual rate. As with any case, it is all dependent on the situation and how much info you have on the matter. This also means some cases will not be recoverable with our normal process and would require further legal action.

Final Thoughts

It is up to you if your debt is worth following up, but we are ready for it. Although pricing probably isn’t so much a worry for a write-off, you can find our fee structure here to help make a decision. Even better then recovering write-offs, how about reducing how many you get? I always mention we have our FREE protection service to help mitigate debts and issues.

Submit your interest in having us look over your contracts and quotes here.

We have more blogs for our services and notes from experience in this industry. I hope you can profit from these notes written.

Henley Recoveries Group are a no-win, no-fee debt collection agency with an excellent track record of collections. Recover your unpaid invoices by submitting a debt with us.

Contact us on our main phone, 0466 243 114 or email info@henleyrecoveriesgroup.com.au to discuss how we can help.