Avoid Using Debt Collection

Many businesses avoid using debt collection as they have no use for it. By our existence as a company, you can tell many others cannot avoid needing recovery services. How do they do it?

It may seem counter-intuitive for us to advise how to avoid using our services. However, your efforts to mitigate unpaid accounts relieves time and stress on your end and makes collection efforts more straight forward if needed.

Here are simple things you can do to your current system to mitigate debts in the future.

Prepare

To avoid using debt collection, you need to prepare for the journey your invoice may take. Just like a family outing where you need to bring hats, water bottles, food, a book for kid 1, spare change of clothes for kid 2 as they always get messy, GPS tracker for kid 3 as they always run off…..

There are so many things which could happen to your invoice. As the example above also shows, the more work you have, the more that can happen and the more prepared you may need to be.

This can look like changing your workflow from calls to confirmation in writing. Maybe your next step is written and signed contracts. What about having a scheduled process to follow invoices along their perilous journey…

Process

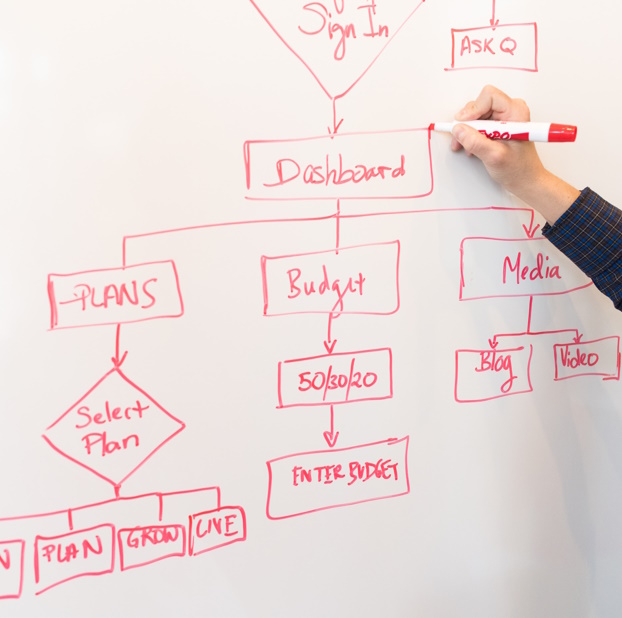

I am a simple guy, my brain works 1-2-3, cause and effect, what is the next step. We believe to avoid debt collection, your accounts should be similar. For example:

- Due Reminder

- Follow-up #1 X days overdue

- Follow-up #2 X days overdue

- Final Warnings X days overdue

- Action

Having a set template for follow-ups keeps the stress of figuring out how to get your payment away. Doing this keeps the pressure on your debtor and creates the urgency for payment to be made. We find creating an ethical sense of urgency and importance to a debt is one of the best ways to recover debts.

A process cannot be the be-all and end-all as a debt is not always cut-and-dried. Sometimes some finesse is needed.

Propose

So there’s more to your debt than meets the eye. Does your debtor dispute the invoice? In financial hardship? Ceasing communication? Making unfair demands? This may hurt, but sometimes you must swallow up your pride to resolve the situation, whether the principle is correct.

Although it may be difficult, proposing alternative ways to resolve the matter can be the final steps you can take to avoid using debt collection. This step really depends on how willing you are to settle for a lower amount or agreement.

As every situation is different, we can recommend is that all proposals is put in writing. If it’s a settlement, put forward a without prejudice offer to save on costs with 7 days to accept – that kind of thing.

Then what?

Worst case scenario, you are left with us, the collectors.

Thankfully, we are used to the situation never being the same and we are ready to deal with what you have to throw at us. If you are unsure if you have done all you can to chase up an unpaid invoice, give us a call. We will be happy to discuss if you have done everything you can to avoid using debt collection and what we can do to assist.

Better Accounts Equals Better Profit

A good business owner is always counting the cost of the work they do. For a builder, this is moving their margin when material costs rise (thanks COVID), for a mechanic, it is quoting for the time the job will likely take, for the accountant it is billing for the time spent working on the books. Despite this, time spent chasing up unpaid invoices isn’t always taken into account and it can really eat into your profit by taking you away from what you do best. Whilst it is a necessary evil, we will let you in on a little secret, better accounts equals better profit. Here is why:

Time Wasted

It is easy to get caught up in perfecting your trade and leaving accounts to themselves. Unfortunately, we live in a world where reminders and follow-ups are needed to get things done. Keeping on top of your invoices and payments, increasing your cash flow will also give you peace of mind, help you sleep at night. That being said, every call, text, email, letter and meeting is a time where you could be either working, earning greater profits, living life or anything else that is not wasting your time and effort.

Despite all the time and money saving you are achieving in your work, the time wasted here can make a large debt in your earnings.

Lack of Accountability

Forgetful clients are one thing, what about the evaders or fighters? Unfortunately they exist, many for very good reasons. Ensuring that they are aware that you are watching all your outstanding debt and incoming payments, makes them more likely to pay. The squeaky wheel gets the grease, so to speak. Even so, following these clients up can be one of the more time consuming processes. Long term outstanding accounts can be the difference between a successful and stressful year.

An example we hear all to often is a small $2k invoice which has had hours upon hours of discussions, meetings and attempts to contact without payment. Unfortunately in some of these cases, the client had no reason to pay immediately as there was no real pressure to do so. Having the correct forms, contracts and plans for these clients is imperative to ensure you are paid.

Some ways to combat this are having the paper work and repercussions set up, like what we assist with in our free protection audit (shameless plug). Being able to legally on-charge admin fees, collection fees, interest and potential legal fees will allow you to be able to hand the matter to debt collectors without having to worry about more time and money wasted.

Lack of Process

So you are a smaller business. Family run? Sole Trader? You may not have or have needed a real process to your accounts management. What steps do you take to ensure you are paid? How can you get better accounts and also get better profit? Some important steps are:

- Credit check prior to engagement

- Quoted works in writing

- Consistent follow-ups for a set period of time

- Firm dates and firm repercussions as a result of prior written agreements

Lack of Time

Especially if you are a smaller business or maybe a larger one with too many invoices to chase up, there is not enough time in the day to recover everything. Most businesses will hire a bookkeeper for a few days a week to cover this. Well done, what a great first step! If you are unsure of what you could do next, our next shameless plug is our Accounts Receivable Process.

Let us handle your accounts for you. Guaranteed, consistent follow-ups, advice and ease of moving those harder cases straight to collection. Have a look at our page here for more info on what this looks like for you and if we can fill the gap in your business. We hope that we can give you a better accounts process so you can have a better profit. Let us take on the stress of collecting your payments so you can continue doing what you do best. Making money.

Why Should You Recover Funds through a Collection Agency?

Every business owner knows how essential cash flow management and time management are. To successfully manage the operations and finance of running a business is a challenging task, especially during periods of economic instability. A debt recovery agency is one of the essential services that your business needs to have on call – and this is why:

Your time as a business owner is valuable

Business owners, especially those of a small to medium-sized business are generally pretty busy people. As a business owner, you are responsible for overseeing everything that your company does – from accounts, to marketing and staff management, let alone the products and services that your business actually provides.

Put simply: as a business owner, you should not be spending your valuable time chasing overdue invoices. It can be a rabbit-hole of constant following-up, waiting for replies, filtering through excuses and negotiating. By the time you have collected an overdue account, your time (if we were to translate it to currency) would probably outweigh the debt. There are some things that only a small business owner can handle – and your time is better spent on that than collecting accounts.

Hiring a collection agency is risk-free

Collection agencies like ours – that operate on a no-win, no-fee basis – mean that you do not have to make any upfront payments to commence collection activity. Basically, if the debt isn’t collected, then you don’t pay anything. If the funds are recovered, the commission is taken from that amount and the remainder is paid into your dedicated account. If you think about it, the debt hasn’t been paid yet and isn’t going to be paid if you don’t at least try to collect it.

Perception and authority go a long way

When a debtor is contacted by a collection agency, it shows a natural process of escalation. If a client isn’t paying you prior to being contacted by a collection agency, then they probably won’t at all. The fact that collection agencies have partnerships with credit bureaus and they can affect your credit score, often prompts conversations with debtors. Utilising debt recovery services shows that as a business and a brand, you take non-payments seriously – improving your reputation and even preventing further non-payments in the future.

Debt recovery agents are skilled at their job

It sounds obvious, but debt collectors are professionals in their field. It means that they are skilled in dealing with people, weeding out dishonest excuses for non-payments, opening up conversations and much more. Plus, detailed notes and records of conversations are kept, meaning that persistent or changing excuses do not go unnoticed. Professional recovery agents also know the relevant laws and legislations around collecting overdue accounts, saving you time on researching and trying to develop strategies.

Preserve client relationships

It may seem counterintuitive, but by passing on a debt to a recovery agency can actually help you to maintain positive client relationships. Let someone else handle the difficult client conversations for you. If debt recovery is built into your everyday accounting practices, then it becomes a standard process. Debt recovery agencies like Henley Recoveries aim to seek amicable recovery solutions for our clients wherever possible, as we understand the importance of these client relationships. In fact, you can even request that a recovery agency act as an extension of your accounts receivable department!

There are many more ways that a debt recovery agency can help your business to become even more effective. Streamline your accounting processes and refer overdue invoices to recovery professionals for amicable debt collection. Your time and resources as a business owner are far more valuable doing what only you can do – running your business, than they are chasing overdue payments.

Henley Recoveries Group specialise in cash flow management, accounts receivable and debt recovery. For amicable debt recovery and to improve your cash flow, submit a debt for collection with no upfront costs, and a no-win no-fee structure. You can also book in a consult with one of our debt recovery specialists to discuss all of the options available to our clients.

7 Cash Flow Management Tips for Small Businesses

Cash flow can make or break a small business. Successfully managing incoming and outgoing expenses is more crucial than ever this year. If cash flow is poor, opportunities are limited, business growth is stunted and running a business is definitely more stressful. However, positive cash flow means that you can invest in resources that will help your business to grow and prevent times where cash flow is down.

Here’s our top 7 tips for promoting positive cash flow within your business.

1. Send Your Invoices Out – Quickly

It makes sense: the sooner you send an invoice out, the sooner you can get paid. Getting invoices to clients promptly ensures that your services are fresh in their minds and gives them time to make payment. Set aside time in your schedule regularly to send, follow up and reconcile invoices.

2. Create an Accounts Receivable Timeline

Having a strict accounts receivable process (and sticking to it) means that you can stay on top of amounts that you are owed. Make sure that you define this process and have strict timeframes put in place.

For example, as soon as an invoice becomes overdue, send a reminder to your clients. In that reminder, request payment within the next 7 days. If you still don’t hear back from them after one week, give them a call. Should they still not make payment or get in touch with you, send the invoice to a debt collector – the sooner you refer the debt to a collector, the more likely the amounts are to be recovered.

You can find more information on following up unpaid invoices in our last blog post. Or contact us at info@henleyrecoveries.com.au if you’d like more information about our accounts receivable services.

3. Review Your Options for Payment

The more methods that you make available to your clients for payment, the most opportunities you have to get paid. Consider investing into different types of payment options, including EFTPOS/card payments, BPAY and direct debits, as well as ‘buy now pay later’ options, such as AfterPay and ZipPay.

4. Future-Proof Your Cash Flow

All businesses have ebbs and flows – it’s never static. During a positive cashflow period ensure that you’re investing into resources to protect your cash flow during tough times. For example, you could invest into marketing to ensure that you retain a steady stream of sales. You could even invest in new products, or training staff in different areas to expand your product and service offering.

5. Consult a Finance Professional

Engaging the services of a financial advisor doesn’t have to happen when your business isn’t doing well. When consulting a professional, they can help you to review your current processes, create a plan and put measures in place to prevent future losses. The Australian Government has details and recommendations on financial counsellors on the MoneySmart website.

6. Review Your Credit Terms

Providing credit to customers isn’t a bad thing. However, it can go downhill quickly if you don’t have strict terms that you provide that credit under. Ensure that your terms of trade, or client engagement contracts have clauses that protect you from incurring costs when collecting and following up on unpaid invoices.

7. Perform Credit Checks

Prior to engaging into a sizeable contract with a client, ensure you perform a credit check to see if there are any mercantile enquiries, payment defaults and other late or missed payments lodged against them. This allows you to ensure you aren’t engaging with clients who have a record of avoiding payments. You can request a credit check from Henley Recoveries Group by emailing us.

No matter the size of your business, cash flow management is important. By building out an accounting regime and planning for the future, you are preventing losses during months where cash flow is limited. Ensure that you are investing during the good times, so that you can mitigate the impacts of the unknowns and unavoidable situations.

Henley Recoveries Group specialises in cash flow management. Book a consultation with one of our senior consultants for personalised information and advice on your accounts receivable and overdue invoices. You can also Submit a Debt for collection, or call us on 0466 243 114.

Debt Collection: Legal Escalations and Difficult Debts

There is a natural escalation process in debt collection. If a debtor remains unresponsive, or is unwilling to negotiate with collection activity, then your case officer may suggest escalating the debt to our legal process. That process has many different variants and includes cost-effective solutions to aid in collecting money that is owed to you.

Registering the Debt with a Credit Bureau

At Henley Recoveries Group, we are partnered with a major credit bureau. They provide information to many different entities, including major banks, utility companies and other financial institutions. Before working with a new client, many businesses perform what is called a ‘credit check’ as a standard procedure. This means that they look at the data provided to credit bureaus and ensure there are no red flags, or debts recorded with them.

If a debtor remains unresponsive and unwilling to discuss the matter at hand, a strong option is to register that debt with our credit bureau. This means that the debt owing to you can be entered against the debtor’s credit file and may prevent them from receiving loans, credit and other services that perform credit checks prior to engaging in service. It also prevents the debtor from doing the same thing to other vendors. Registration of the debt is affordable and able to be effective on both small and large debts.

Lodging a Claim with the Small Claims Tribunal

In Australia, each state has a tribunal body that hears cases to do with small claims. Each tribunal has different rules and regulations, but they all hear civil disputes and debt cases. The greatest benefit for taking a debtor to small claims court is that you will receive an enforceable, concrete judgement on the debt. This means that the judge will make a call on how much is owed and to whom.

If negotiations and communications are not working, a lodgement with the tribunal is the option we most highly recommend. If the debtor remains unresponsive, we can even request a default judgement to be ruled in your favour. A bonus positive is that a majority of the fees you will pay to submit your case to the tribunal can be requested back in the claim that you make! We can even make the tribunal submission on your behalf.

Send Out a Licensed Field Agent

You may have read our previous blog on Field Agents. Sending out a field agent can be a great way to communicate with a debtor. Agents are fully licensed and regulated, adhering to strict rules and debt collection guidelines. Field Agents are a great option if you have limited contact information for your debtor. Sending a field agent out allows you to establish an authoritative presence, as well as confirm the address of the debtor prior to making a lodgement with the small claims tribunal. Field agents can even have the debtor physically sign a payment agreement.

Dispute Resolution Services

More often than not, we act as mediators between debtors and our clients. We help our clients to negotiate, correspond and come to an agreement with their debtors, ensuring they recoup as much of the funds that they are owed as possible. A lot of industries actually have external dispute resolution bodies that the small claims courts require their dispute resolution services to be utilised prior to being heard at the tribunal. It is important to ensure that these avenues are properly utilised prior to other actions being taken, this ensures that your case is strong and won’t be thrown out should you choose to lodge with the tribunal.

Lodge Your Case Through the Court System

Lodging your case through the court system, outside of the small claims tribunal, is another option available to our clients. This option is costly, but again provides a concrete and enforceable judgement on the debt. Generally, this option is for larger debts (usually over $25, 000) that the small claims tribunal won’t hear. Lodging through the courts, whether that be the magistrates, district or supreme court, also allows you to have representation in the form of a lawyer, where the small claims tribunals are usually always self-represented.

No matter what the situation of the debt is, there are always options for recouping monies owed to you. The options above are just some of the escalation points that can be pursued for debts of all budgets. By utilising the natural escalation process, you can take back control of debts owed to you.

Henley Recoveries Group has a specialised escalation process. We are experienced in industry-specific procedures and in writing and submitting claims. Contact us today on 0466 243 114 for more information on our Debt Recovery Services and escalation processes.